Ctrack Transport and Freight Index shows further moderation

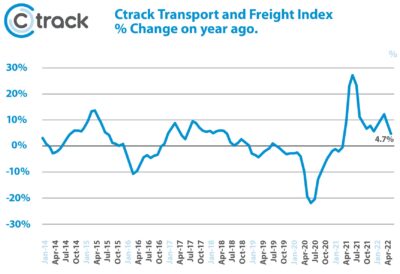

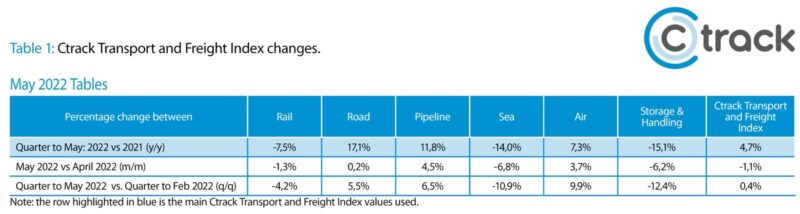

In the aftermath of the heavy rains and floods that occurred in KwaZulu-Natal in mid-April, which caused a major disruption to the Port of Durban, the logistics sector of South Africa remains under pressure. The Ctrack Transport and Freight Index for May 2022 reported a decline of 1.1% compared to the previous month, however, the year-on-year figure still equates to a 4.7% improvement, though a clear moderation is evident.

“Many challenges remain for the sector and the economy in general. These include an erosion of productivity due to regular load shedding and ongoing significant fuel price increases. With the blockage of the N3 during June still fresh in the memory, it is unlikely that June will provide any comfort to the sector either,” said Hein Jordt Chief Executive Officer of Ctrack Africa.

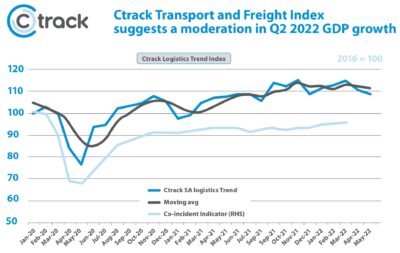

Graph 1: Ctrack Transport and Freight Index % change on year ago.

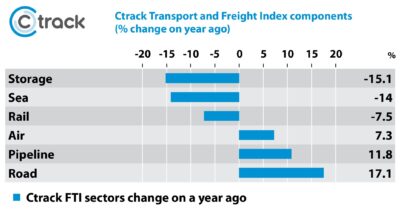

Graph 2: Ctrack Transport and Freight Index components (% change on year ago)

A closer look at the sub-sectors reveals winners and losers once again. Three of the six sub-sectors of the Ctrack Transport and Freight Index declined during May, with the biggest contractions evident in Storage and handling (warehousing) and Sea Freight, while the heavy-weighted Rail Freight sector, which accounts for 22.6% of the index, also remains under pressure. Both Sea Freight and Rail were particularly hard hit by the floods in the Durban area and are still in the process of recovery. On June 13, Transnet Freight Rail (TFR) reopened a single line on the container corridor between Durban and Cato Ridge, where operations had been suspended since April 11. Additional capacity will be unlocked on the mainline in September when repairs on the second line are planned to be completed, and the line reopened to traffic.

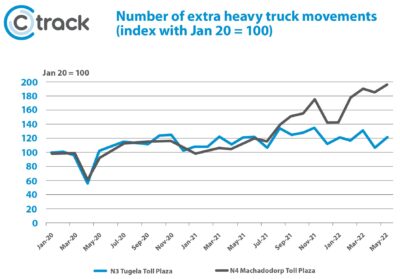

During May, Road Freight once again remained the star performer among the different sub-sectors of the logistics industry, increasing by a notable 17.1% on a year-on-year basis. Road Freight has clearly taken up the slack created by the ongoing underperformance of the Rail Freight sector. While Road Freight remains the preferred option for reliable transport of freight, there have been some interesting trends developing on the two main routes. A look at the class 4 trucks (extra-heavy trucks) travelling on the two main corridors revealed that the N4 corridor had seen increased growth, while the number of trucks using the N3 corridor has been fairly stagnant since July 2021. The N3 has been hard hit in the past year, from the looting in July 2021 to the most recent (and recurring) blockage that cost the logistics industry millions. Add to this the negative impact the flooding has had on the operations at the port of Durban, and it is probably no surprise that exporters are looking for alternative export terminal options.

Graph 3: Number of class 4 extra heavy trucks on N3 vs N4 routes (index with Jan 20 = 100)

The privately run port in Mozambique’s capital Maputo has been expanding its capacity to receive shipments, with a 1.05km stretch of newly dredged berths that will allow larger cargo vessels to dock at Maputo. Recent reports on the port’s expansions highlighted that Capesize bulk cargo ships, which cannot pass through the Panama or Suez canals because of their size, will now be able to call in at Maputo. These vessels can carry up to 180 000t of dry-weight freight. That being said, the Sea Freight sector of the Ctrack Transport and Freight Index declined by a notable 14.0% in May compared to a year ago. In addition, container handling in the port of Durban has only recovered by 84% compared to its performance in March this year, still lagging on its pre-flood performance.

In addition to container handling, all other categories of freight, including dry bulk, break bulk and other freight, also recorded declines during May. While cargo handling declined by 19.8% in May compared to the same period last year, other cargo handling (excluding vehicles) dropped by 10.0%. Given that the Ctrack Transport and Freight Index is calculated on a three-month moving average basis, the impact is softened somewhat, and this sector will, in all likeliness, cause a decline in the overall Ctrack Transport and Freight Index in the coming months.

Rail Freight remained under pressure during May, declining 7.5% year on year. This is partly due to the troubles at the Durban port as well as a variety of other issues such as inadequate infrastructure and crime incidents on rail lines which remain an ongoing issue.

On a more positive note, transport of liquid fuels via Transnet Pipeline Lines (TPL) increased by 11.8%, and the inland market seems to be well supplied. With international supply chains recovering gradually, while economic conditions are normalising in the wake of the COVID-19 pandemic, Air Transport continues to improve steadily.

The Air Freight component of the Ctrack Transport and Freight Index increased by a healthy 7.3% during May. Total consolidated airport flight movements (passengers and freight) were up by 31.1% in May, compared to a year earlier. One can expect that Air Freight will continue to report improvements as the international travel industry continues to normalise during the next year or two. Storage declined abruptly in May, with inventory levels declining across the board, while transhipments were also notably lower.

Ctrack Transport and Freight Index and GDP growth.

It is well known that the transport sector’s performance and a country’s Gross Domestic Product have a close relationship. Graph 4 depicts that the logistics sector in South Africa outperformed the broader economy in the recovery phase post-COVID-19.

While Q1 2022’s real GDP growth was better than expected, the Ctrack Transport and Freight Index reveals that the economy lost some momentum in quarter two, partly due to the impact of the KZN flooding and logistical issues on the N3 but also due to regular load shedding, and higher inflation and interest rates.

“Many of the high-frequency economic indicators paint a similar picture to what the Ctrack Transport and Freight Index does. For example, the ABSA PMI (reflecting conditions in the manufacturing sector) moderated in June, whereas the S&P Global SA purchasing managers index (reflecting wider conditions in the private sector) recorded the highest reading in 13 months. This is typical of an economy in a stop-start mode, unable to gain synchronised momentum across sectors, as the next round of load shedding or some or other headwind is probably waiting around the next corner,” concluded Jordt.

Graph 4: CTFI suggests a moderation in Q2 2022 GDP growth.

With the recent and unexpected passing of Mike Schussler, the leading economist and contributor to the Ctrack Transport and Freight Index, Ctrack is continuing the very valuable Ctrack Freight and Transport Index. Together with economists.co.za and independent economist Elize Kruger, the health of the South African Transport and Freight industry will still be researched and presented monthly.